In today’s dynamic business environment, the importance of risk management cannot be overstated. One crucial aspect of this risk management strategy is the use of Certificates of Insurance (COI). In this article, we will delve into the definition and significance of COIs, exploring their types, components, and the impact they have on various industries.

Types of Certificates of Insurance

General Liability Insurance serves as the foundation, with additional specific certificates tailored to cover property, workers’ compensation, auto liability, and more. Each type addresses distinct aspects of risk, providing comprehensive coverage.

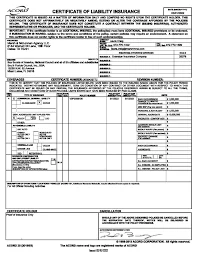

Components of a Certificate of Insurance

A COI typically includes information about the insured party, policy details, and specific coverage information. Understanding these components is vital for businesses to assess their risk exposure accurately.

How to Obtain a Certificate of Insurance

Businesses can obtain COIs by requesting them from their insurance providers. This process is especially crucial for contractors and subcontractors, ensuring that all parties involved are adequately covered.

Importance in Risk Management

Beyond mere paperwork, COIs play a crucial role in risk management by ensuring vendor compliance and fostering positive business relationships. They act as a safety net, protecting businesses from unforeseen liabilities.

Common Mistakes to Avoid

Inaccurate information on COIs can lead to significant consequences. Businesses must be vigilant in avoiding common mistakes such as providing outdated certificates or inaccurate policy details.

Regulatory Compliance

Non-compliance with legal requirements for COIs can result in severe consequences. Understanding the regulatory landscape is essential for businesses to avoid legal pitfalls.

Certificate of Insurance vs. Additional Insured Endorsement

Distinguishing between these two options is vital for businesses. We explore the differences and guide readers on when to choose each option based on their specific needs.

Real-Life Examples

Examining case studies helps illustrate the real-world impact of having or lacking proper insurance coverage. Learning from industry practices, both successful and challenging, provides valuable insights.

Future Trends in Certificate of Insurance

As technology advances, so does the landscape of insurance. We explore emerging trends and innovations that are shaping the future of COIs and risk management.

Tips for Effectively Managing Certificates of Insurance

Digital solutions and internal protocols are instrumental in efficiently managing COIs. Implementing these tips can streamline the process and ensure that businesses are always adequately covered.

Educating Stakeholders

Ensuring that employees and partners are aware of the importance of COIs is crucial. Training programs and awareness campaigns contribute to a culture of responsibility and risk awareness.

Case Studies: Success Stories and Challenges

Exploring both success stories and challenges faced by businesses provides a comprehensive view of the impact of COIs in various scenarios.

Industry-Specific Considerations

Different industries may have unique requirements for COIs. Tailoring certificates to meet specific sector needs is essential for comprehensive coverage.

Conclusion

In conclusion, Certificates of Insurance are not just documents; they are vital tools in mitigating risk and ensuring the stability of businesses. By understanding their importance, businesses can navigate the complexities of risk management more effectively.

FAQs

- Why is a Certificate of Insurance important for businesses?

- A COI provides a safety net, protecting businesses from unforeseen liabilities and ensuring vendor compliance.

- How often should businesses update their Certificates of Insurance?

- It is advisable to update COIs whenever there is a change in policy details or at least annually to ensure accuracy.

- What are the consequences of non-compliance with regulatory requirements for COIs?

- Non-compliance can result in legal consequences, fines, and other penalties.

- Can businesses rely solely on general liability insurance, or is it necessary to have additional certificates?

- Depending on the nature of the business, additional certificates may be necessary to ensure comprehensive coverage.

- How can businesses stay informed about future trends in Certificates of Insurance?

- Regularly engaging with industry publications, attending conferences, and staying updated on technological advancements are ways to stay informed about future trends